Frequently Asked Questions

Hopefully we're answering all of your burning questions!

If not, contact us with any additional inquiries.

Using the Cashola® Card

Cashola Prepaid Debit Mastercard® is issued by Pathward®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. Unless specifically noted otherwise, any other product or service mentioned, other than the Cashola Prepaid Debit Mastercard, is not a Pathward or Mastercard product or service.

Yes! Goalsetter allows a Parent/Guardian to set up two types of spending controls:

- Limit spending amount with frequency

- Ability to set a monthly or a rolling two-day limit for each kid individually.

- Limit by merchant category type through the Cashola Control Center in the Goalsetter App.

- Based on each merchant’s category code they are grouped into 8 categories, and the parent can block as many categories as they choose.

By default, Goalsetter proactively blocks all kid Cashola Cards from use at adult merchants, such as liquor stores, gambling, casinos, adult services, etc.

Getting Started

To open a Goalsetter profile you must be an adult (which means over the age of 18 in most U.S. states) to have access to our Savings accounts and other bank and investment features, provided by our partners:

- Savings Account: Webster Bank, N.A., Member FDIC

- Debit Card and Wallet: Pathward, N.A., Member FDIC

- Investment Account: DriveWealth, LLC

If you are a teenager (ages 13 - 17), you can onboard with Goalsetter for Teens and will have access to our educational features and games, but no access to the bank or investment features until your parent or guardian accepts your invitation and onboards to Goalsetter Parents/ guardians can add a kid aged 6 and over directly and they too can have access. To set up a profile for Goalsetter App access, the user must be 6 years or older.

Goalsetter Profile Management

Yes you can, in two different ways. First, once you’ve opened your Goalsetter account, you can send money to other Goalsetter users in near real time. Second, using a GoalCard. Once redeemed, the money will be deposited into the recipient's account immediately.

We hate to see you go! To close your account all funds must be removed out of Goalsetter. Here are the steps to take to ensure all accounts have a balance of $0:

- Cash out all the money from your own and your family's accounts: Debit cards, Savings, Goals, and Wallet (it takes up to 6 business days.)

- Sell all your own and your family’s investments and pending stock orders. After 2 business days, withdraw all that money from your Cash To Invest.

- Make sure that the withdrawn amount settles in your linked funding account, which can take 3-4 business days.

- All pending transactions must be settled.

Under Menu, go to Accounts, then Account Management. From there you can decide to close your account or just a specific financial services account.

Saving Features

Goalsetter is happy to offer a competitive interest rate. You will be given 30 days notice if the rate changes. Details regarding the interest rate and calculation can be found in the Truth and Savings agreement here: https://goalsetter.co/truth-in-savings-disclosure/

There is no initial deposit or minimum balance required to open your account or minimum balance required to obtain the annual percentage yield (APY).

Family Management

Security & Customer Support

Goalsetter Gold Changes

To do this, you will need to initiate a Full ACAT transfer by contacting the receiving broker. DriveWealth, the current clearing broker-dealer for your GoalSetter Gold account, must receive the transfer instructions, including DTC #2402 and Account Number (CORR-001-DWAccount Number), from the receiving broker by October 3rd, 2025 to complete the transfer.

Please note, fractional shares cannot be transferred and there is a fee of $65 per ACAT transfer.

If you have stocks, follow these steps to access your investment funds:

- Open your investment account or your child’s investment account and scroll down to view your portfolio and holdings.

- Click on the stock you want to sell, then tap the yellow "Sell" button.

- Choose the selling option that best suits your needs.

- On the selling screen, select "Sell All" or manually enter the amount you'd like to sell.

- Confirm the transaction. If the market is closed, your order will be processed on the next business day at 9:30 AM EST.

Please note: It may take up to two business days for the funds from a sold stock to become available for withdrawal.

To move funds from your investment account to your Goalsetter savings account:

- Open your investment account or your child’s investment account.

- Click on "Move Money" and select "Withdraw Money."

- Choose the savings goal you'd like to transfer the funds to.

- Enter the amount you'd like to move and tap "Continue."

- Review the transaction details and confirm.

Your funds should transfer almost instantly.

If no action is taken, any remaining assets will be liquidated, and the resulting funds will be transferred to your Goalsetter savings account. You will receive notifications for each transaction.

Users who take no action will be downgraded to the Goalsetter Basic account and will be charged a $3.95 monthly fee.

If your subscription is sponsored, please check the “Subscription and Billing” section for the specific end date of your sponsorship and additional details.

If you were on a sponsored Basic plan and later upgraded to Gold on your own, your account will return to the complimentary Basic plan once the Gold subscription ends. You will not be charged the $3.95 fee.

To downgrade from Goalsetter Gold to the Basic plan, follow these steps:

- Go to the Menu in the Goalsetter app.

- Select Goalsetter Plan.

- Click on the three dots next to Goalsetter Gold and choose Change Plan from the pop-up menu.

- Select the Basic Plan and click Continue.

- Click Start Now to confirm your selection.

Important: If you are closing your account, you will need to downgrade to the Basic plan before proceeding with account closure.

To close your Investment account (along with all linked kids/teens investment accounts):

- Open the Goalsetter app and log in.

- Tap the Menu button at the bottom of the Dashboard.

- Select Accounts and then select Me.

- Click the settings wheel in the top right corner.

- Select Close Investment Account.

- Enter your password and select Close Investment Account.

Yes. You will receive access to tax documents and statements for your investments for the applicable tax year through DriveWealth.

If you have any questions, please reach out to us at hello@goalsetter.co, and our team will be happy to assist you.

Escheatment is the process by which unclaimed assets are turned over to a state when the owner cannot be located or is deceased with no heirs.

When property reaches the end of a dormancy period (established by each state) with no owner contact, the organization by law, must identify and report the unclaimed property.

Organizations must make a good-faith effort to reach the owner of the property before turning it over to the state for safekeeping. Attempts may be made by letter, phone call, electronic communication, or other means.

If your Goalsetter Gold account has a $0 balance, your next step is to downgrade to a Goalsetter Basic account. To do this

- Go to the Menu in the Goalsetter app.

- Select Goalsetter Plan.

- Click on the three dots next to Goalsetter Gold and choose Change Plan from the pop-up menu.

- Select the Basic Plan and click Continue.

- Click Start Now to confirm your selection.

This ensures your account remains active for savings and other Goalsetter features.

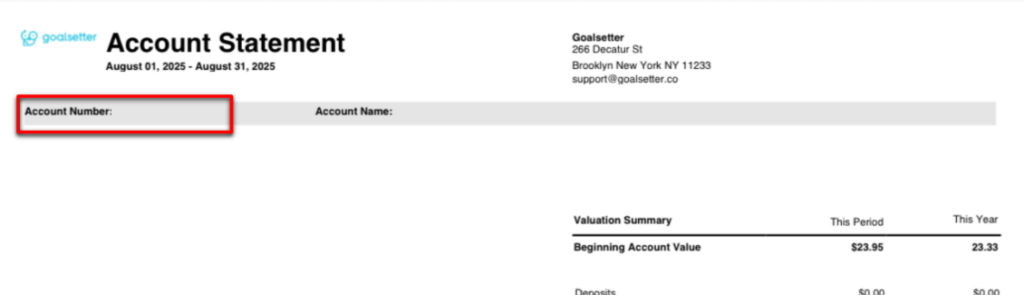

To view your Goalsetter Gold statement:

- Open the Goalsetter app and log in.

- From your Dashboard, select Investing.

- Click on My Activity and then select the Document icon in the upper right corner of the screen.

- Under Investment Documents, select Investment Statements.

- Choose the month and year of the statement you want to view.

Goalsetter Gold Changes

To do this, you will need to initiate a Full ACAT transfer by contacting the receiving broker. DriveWealth, the current clearing broker-dealer for your GoalSetter Gold account, must receive the transfer instructions, including DTC #2402 and Account Number (CORR-001-DWAccount Number), from the receiving broker by October 3rd, 2025 to complete the transfer.

Please note, fractional shares cannot be transferred and there is a fee of $65 per ACAT transfer.

If you have stocks, follow these steps to access your investment funds:

- Open your investment account or your child’s investment account and scroll down to view your portfolio and holdings.

- Click on the stock you want to sell, then tap the yellow "Sell" button.

- Choose the selling option that best suits your needs.

- On the selling screen, select "Sell All" or manually enter the amount you'd like to sell.

- Confirm the transaction. If the market is closed, your order will be processed on the next business day at 9:30 AM EST.

Please note: It may take up to two business days for the funds from a sold stock to become available for withdrawal.

To move funds from your investment account to your Goalsetter savings account:

- Open your investment account or your child’s investment account.

- Click on "Move Money" and select "Withdraw Money."

- Choose the savings goal you'd like to transfer the funds to.

- Enter the amount you'd like to move and tap "Continue."

- Review the transaction details and confirm.

Your funds should transfer almost instantly.

To downgrade from Goalsetter Gold to the Basic plan, follow these steps:

- Go to the Menu in the Goalsetter app.

- Select Goalsetter Plan.

- Click on the three dots next to Goalsetter Gold and choose Change Plan from the pop-up menu.

- Select the Basic Plan and click Continue.

- Click Start Now to confirm your selection.

Important: If you are closing your account, you will need to downgrade to the Basic plan before proceeding with account closure.

Yes. You will receive access to tax documents and statements for your investments for the applicable tax year through DriveWealth.

If you have any questions, please reach out to us at hello@goalsetter.co, and our team will be happy to assist you.

Escheatment is the process by which unclaimed assets are turned over to a state when the owner cannot be located or is deceased with no heirs.

When property reaches the end of a dormancy period (established by each state) with no owner contact, the organization by law, must identify and report the unclaimed property.

Organizations must make a good-faith effort to reach the owner of the property before turning it over to the state for safekeeping. Attempts may be made by letter, phone call, electronic communication, or other means.

If your Goalsetter Gold account has a $0 balance, your next step is to downgrade to a Goalsetter Basic account. To do this

- Go to the Menu in the Goalsetter app.

- Select Goalsetter Plan.

- Click on the three dots next to Goalsetter Gold and choose Change Plan from the pop-up menu.

- Select the Basic Plan and click Continue.

- Click Start Now to confirm your selection.

This ensures your account remains active for savings and other Goalsetter features.

Investing With Goalsetter

About the GoalCard®

When you send a GoalCard, you are sending money to enable the recipient to save towards a goal - from airpods to airfare, and beyond!

Allowance

You have three automated Allowance features to choose from:

- Set-It-And-Forget-It; no strings attached, flat rate paid to your kid.

- You’re on Payroll; paid for completion of all chores.

- Entrepreneur-in-the-Making; paid per chore the kid completes.

As a Parent/Guardian you designate and set the amount of money and the frequency you want to pay out allowance to your kid.

- Click on the Kid's Profile

- Go to Allowance

- The previously set Allowance features will show as “Pending” or “PayDay” for you to approve.

It depends on which feature, as the Parent/Guardian, you’ve activated.

Set-It-and-Forget-It is an auto-pay feature that doesn’t require chores to be completed.

For You’re on Payroll, if your Kid doesn’t complete at least one of their set chores, they will not be paid. You can reduce their overall allowance amount or remove chores at any time.

For Entrepreneur-in-the-Making, you can choose to only pay them the designated amount for each of the chores they’ve completed.

All of the Allowance features can be paused or removed at any time. Each kid you have on the platform will also have their own unique chores.

- Go to Allowance

- The previously set Allowance features will show as “Pending” or “PayDay” for you to approve.

Just remember to use your Wallet as the source so the money gets instantly transferred, so be sure to always make sure your wallet has funds! You can set-up recurring contributions to keep it up-to-date.

Move Money

- With someone in your household on the Goalsetter platform

- With another Goalsetter user

- With a non-Goalsetter user with a GoalCard (coming soon!)

When you send money, we’ll show you the expected arrival date. The exact time depends on the transaction type, but typically it takes 1-2 business days.

Goalsetter Account Management

Good question! Here are the steps if you don’t have any Kids on your account:

- Go to Menu

- Select “Accounts”

- On your “My Accounts” page, you will see the list of your current accounts and the “Statements” section for each.

If you have Kids on your account:

- Go to Menu

- Select Profile to see your accounts.

- Select User

- From the My Accounts screen, select the statement

Here are the steps to see your plan details:

- Go to Menu

- Select “Goalsetter Plan”

Your “Goalsetter Plan” screen gives you access to the subscription plan details, including features, the cost, and expiration of your plan, if applicable.