Finally, financial education made fun. And effective too.

With a curriculum fueled by gaming and popular culture, Goalsetter is the financial education solution both kids and teachers have been waiting for.

FinTech Breakthrough Award for “Best Financial Education Platform”

Education at School + Application at Home = Preparation for Life.

Goasletter’s award-winning1 financial education solution is transforming learning inside the classroom, while preparing students for life - and financial success - beyond the classroom too.

77% of parents want financial education

at school and at home.

That's why we offer both

Goalsetter Classroom and the Goalsetter App.

*The Cashola card1 is separate from the subscription plans and is not subject to fees associated with the plan. Users must subscribe to either Goalsetter or Goalsetter Gold to use the Cashola card.

Goalsetter At Home

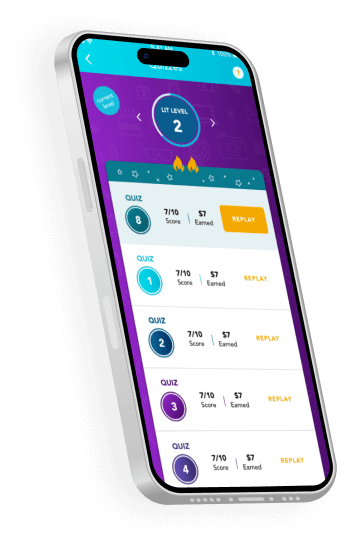

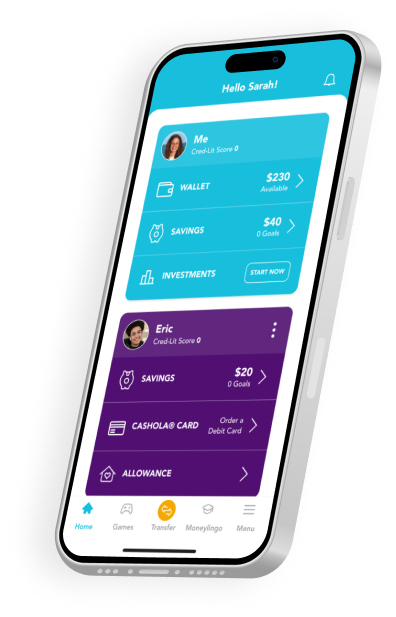

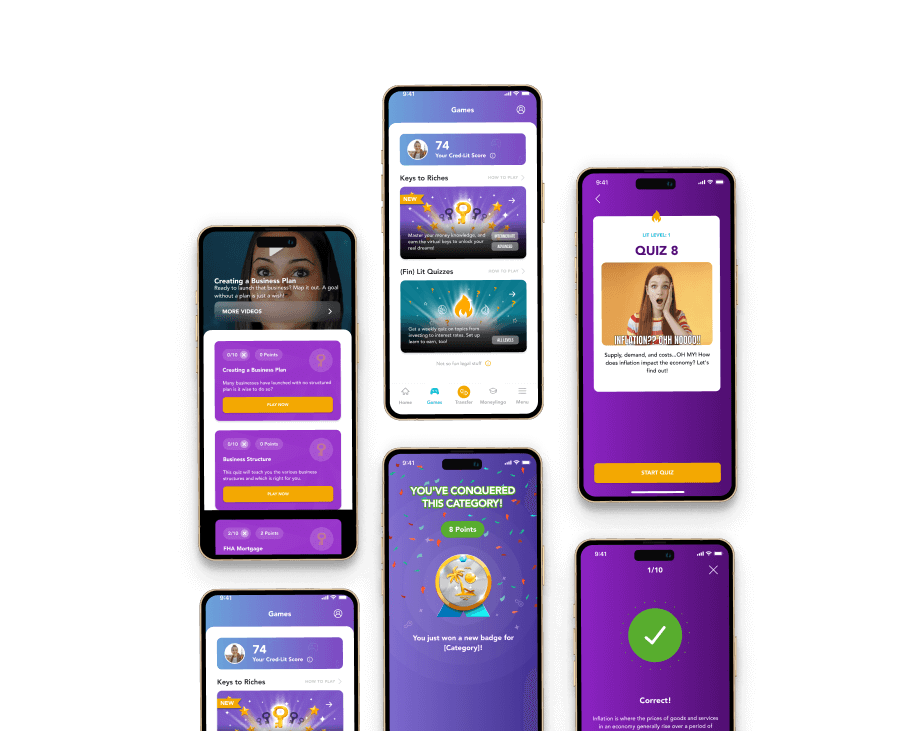

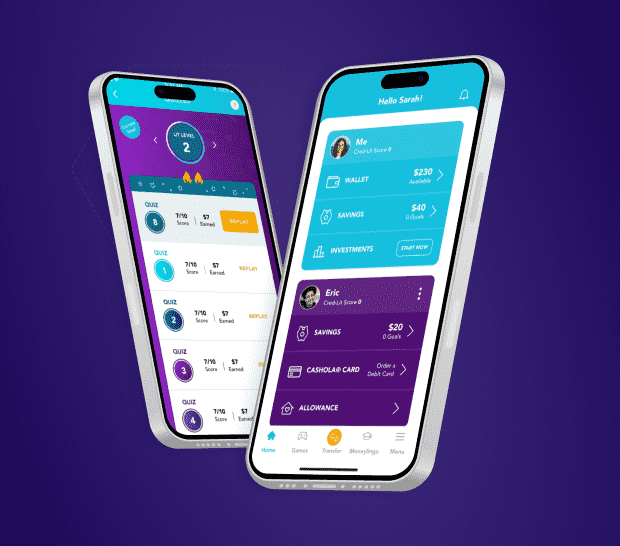

An app with savings account6, debit card2, investment account3, and weekly financial educational quizzes, all mapped to K-12 national standards.

A financial game-changer for your students, Goalsetter extends classroom learning onto students' phones and into their homes.

With the Goalsetter App, financial education becomes a daily lifestyle, enabling kids to use principles of financial literacy in real life.

Goalsetter At School

Middle and High School curriculum mapped to the CEE (Council for Economic Education) national financial literacy standards.

Students love Goalsetter Classroom’s interactive activities, relatable videos, and goal-setting challenges.

Culturally responsive lessons cover financial literacy topics that meet meet Jump$tart national standards and learning targets.

Professional Learning for Teachers

Professional Development that uniquely prepares educators to prepare students for financial success.

While educators are learning skills to support their own financial education, they engage with the Goalsetter Learning Team to implement Goalsetter Classroom with fidelity.

Why Choose Goalsetter for Your School?

Goalsetter equips your school with an engaging financial curriculum, tech-savvy apps, and invaluable real-world tools to help them master the art of financial empowerment.

- Tailored state and national standard-aligned curriculum

- Teacher-friendly suite of materials and assessments

- Diverse, culturally relevant content

- Flexible pacing for individual student needs

- Comprehensive Professional Learning for educators

Tailored state and national standard-aligned curriculum

Teacher-friendly suite of materials and assessments

Diverse, culturally relevant content

Flexible pacing for individual student needs

Comprehensive Professional Learning for educators

Across the USA, Goalsetter is redefining financial education.

In Portsmouth, VA, high school students experienced a 47% growth in mastering financial education standards, achieving 83% proficiency.

(RYE Consulting. Study prepared August 2023)

Our Public-Private Partnerships.

Transforming futures, together.

You're Pretty Smart Right?

SPECIAL REPORT

Revealing the Financial Literacy Gap: What Today’s Students Are Missing

Dive into our groundbreaking report and uncover the surprising truths about the financial understanding of America’s youth – it’s an eye-opener you won’t want to miss.

Experience Goalsetter.

Whether you want to use Goalsetter for your school, or sponsor Goalsetter for students in your community, we’re excited to connect.